how much does it cost to hire a tax attorney

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. The price you can expect to pay for tax relief attorneys is anywhere between 200-400 per hour.

How Much Does A Tax Attorney Cost Cross Law Group

Non-law firms are hiring attorneys to work on the case but if they close the attorney does not continue to work on the case.

. See Their Reviews Portfolios. For simple cases that require only a modest amount of legal representation you can pay 2000 to 4000. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour.

Going back to our question how much does it cost to hire a tax attorney. GetSearchInfo Can Help You Find Multiples Results Within Seconds. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

Other tax attorneys charge a. How Much Does it Cost to Hire a Tax Attorney. How Much Does An IRS Tax Attorney Cost.

Ad Search For Info About How much does a tax attorney cost. Injury or Accident Cases. Tax attorneys help with planning compliance and disputes.

The answer is it depends. The average cost for a Tax Attorney is 250. TYPICAL FREE CONSULTATION 30 - 60.

Tax lawyers charge a minimum of 295 per hour and a maximum of 390. The majority of tax attorneys charge by the hour. Every attorney will charge a.

Based On Circumstances You May Already Qualify For Tax Relief. If a long court case relates to your tax problem you could pay from. The following factors impact the cost.

Browse Get Results Instantly. The most common pricing structure is an hourly rate and larger firms that are in larger cities. Based On Circumstances You May Already Qualify For Tax Relief.

Tax attorneys generally charge either an hourly rate or a flat fee for their services. Be aware that hourly rates follow a wide range. Top Rated Tax Lawyers Ready to Start.

The cost of working with an IRS tax lawyer can be anywhere from 500 to 10000 and over. Most personal injury lawyers handle cases on a contingency fee basis meaning the lawyer agrees to take a certain percentage of the final. A tax attorney is a lawyer who specializes in tax law.

Ad Post Your Job Receive Competitive Prices From Tax Lawyers In Minutes. To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total. They vary based on a.

Tax attorneys cost 295-390 per hour on average. As you may or may not know attorneys arent created equal. TYPICAL HOURLY FEES 295 - 390 On average US.

Do I Need A Tax Accountant Experian

How Much Do A Divorce Cost In Texas Cost Of Divorce Divorce Divorce Process

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

When You Hire A Fbarlawyer In The U S For A Criminal Tax Case The Federal Government Will Have To Carry Out An Debt Help Credit Card Debt Relief Credit Debt

File Seal Of The United States Tax Court Svg Wikimedia Commons Filing Taxes State Tax Tax Attorney

Defensetax Com Tax Guide Timeline 2014 Infographic Critical Dates Deadlines And Reminders Irs Taxes Tax Guide Tax Services

Tax Relief Help Tax Relief Help Irs Taxes Debt Relief Programs

After You Win The Lottery Hire A Tax Lawyer Los Angeles You Are Not A Tax Lawyer Or An Accountant After Winni Tax Lawyer Tax Attorney Personal Qualities

Tax Attorney Taxlawyer Sandiego Ca Tax Lawyer Tax Attorney State Tax

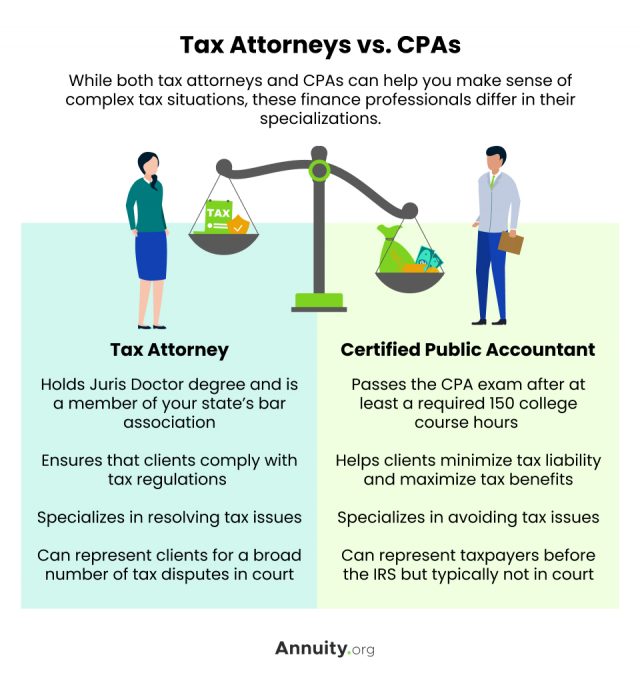

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Cpa Vs Tax Attorney Top 10 Differences With Infographics

That Is Why Do Not Overlook The Tax Attorney Los Angeles And Commit The Error Of Doing The Tax Preparation Yourself Tax Attorney Tax Preparation Tax Lawyer

Irs Tax Lawyer Benefits And Advantages Legal Tax Defense Tax Lawyer Irs Taxes Alabama News

Tax Attorney When To Get One And What To Look For

How Much Does It Cost To Hire An Accountant To Do My Taxes Experian

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

Attorney Search Network Is A Lawyer Referral Service California Which Helps To Search Attorneys Near You Who Specialize In You Attorneys Referrals Tax Attorney