vermont state tax brackets

Rates range from 335 to 875. The table below shows rates and brackets for the four main filing statuses in Vermont.

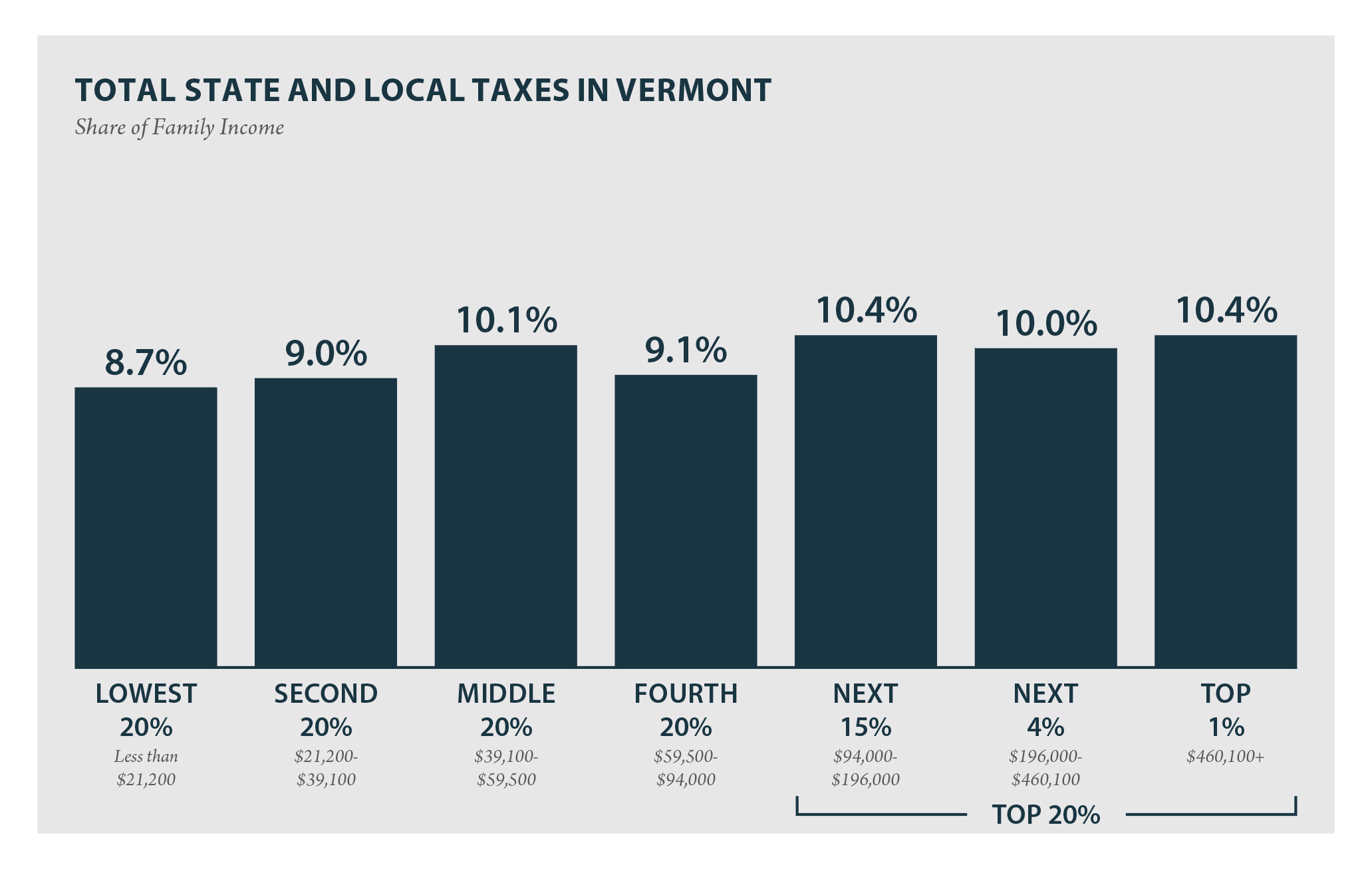

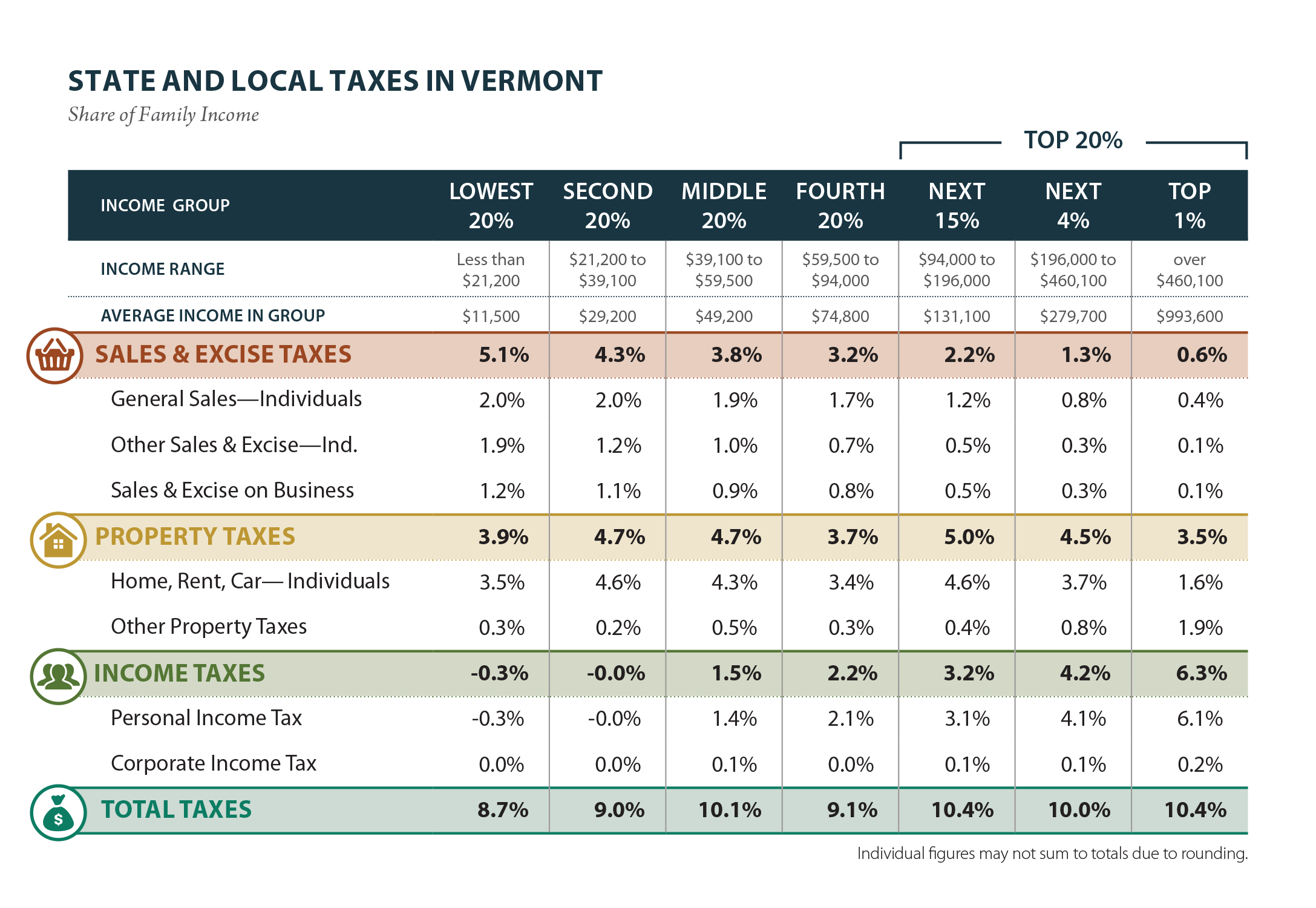

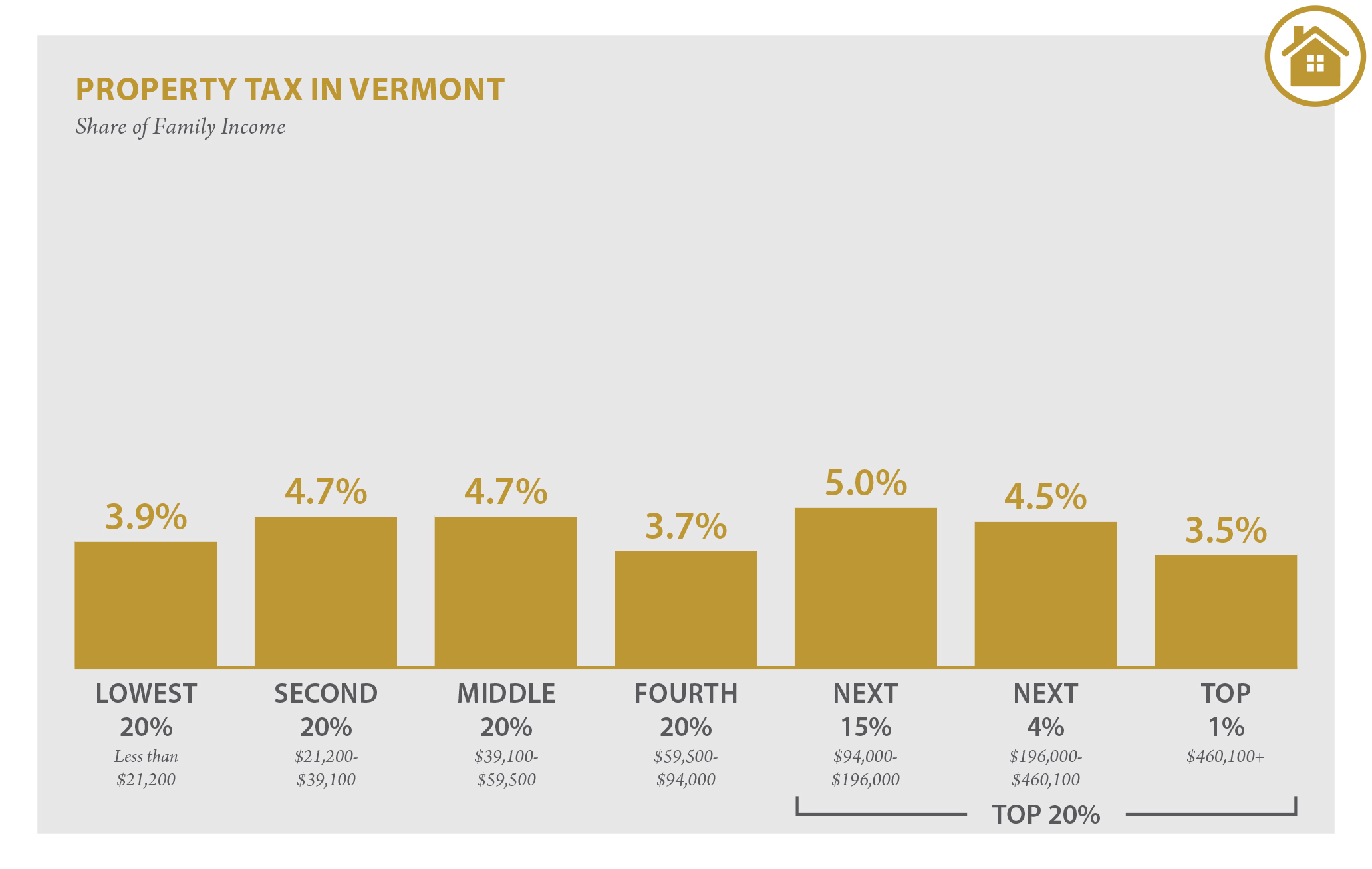

Vermont Who Pays 6th Edition Itep

PA-1 Special Power of Attorney.

. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. Before sharing sensitive information make sure youre on a state government site. 4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax.

The site is secure. The Vermont Department of Revenue is responsible for publishing the. This form is for income earned in tax year 2021 with tax returns due in April 2022.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. The latest available tax rates are for 2020 and the vermont income tax brackets have been changed since 2004. The Vermont State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Vermont State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. The lowest tax rate is 335 and the highest tax rate is 875. Local Option Alcoholic Beverage Tax.

Vermont has 4 tax brackets and 4 corresponding tax rates. 5 5 5 5. IN-111 Vermont Income Tax Return.

Exact tax amount may vary for different items. Ad Compare Your 2022 Tax Bracket vs. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods.

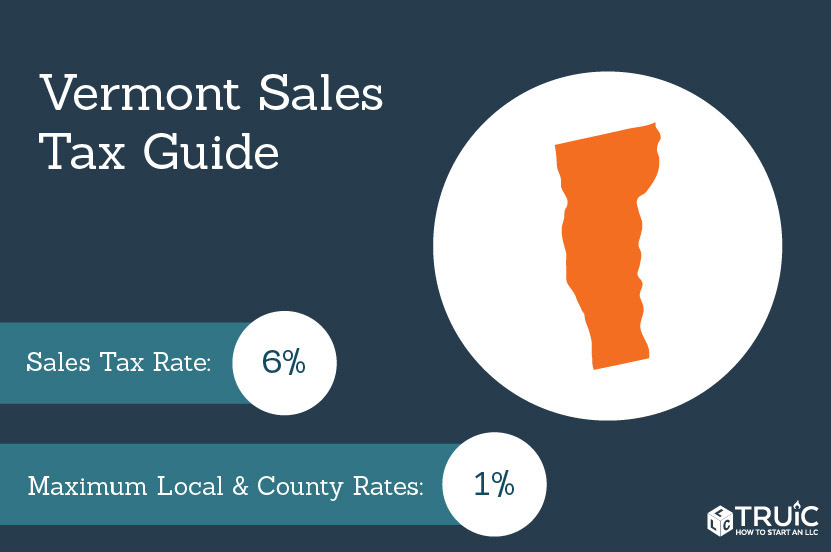

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Before sharing sensitive information make sure youre on a state government site. W-4VT Employees Withholding Allowance Certificate.

Vermont School District Codes. Vermont Tax Brackets for Tax Year 2021. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Then your VT Tax is. The state income tax system in vermont is a progressive tax system. Vermont Income Taxes.

The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the. Tax Bracket Marginal Corporate Income Tax Rate. 2019 Income Tax Withholding Instructions Tables and Charts.

Your 2021 Tax Bracket to See Whats Been Adjusted. 15 15 15 15. 12 12 12 12.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875. State government websites often end in gov or mil. W-4VT Employees Withholding Allowance Certificate.

Vermont also has a 600 percent to 85 percent corporate income tax rate. State and local sales tax rates 2022. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

2022 Vermont state sales tax. 2017-2018 Income Tax Withholding Instructions Tables and Charts. Discover Helpful Information and Resources on Taxes From AARP.

IN-111 Vermont Income Tax Return. 2020 Vermont Tax Tables. 0 0 0 0.

Tax Bracket Tax Rate. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Vermont State Tax Brackets.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. State government websites often end in gov or mil. Tax Bracket Tax Rate.

2021 Tax Brackets and Income ranges will be listed here as they become available. More about the Vermont Tax Tables. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

The combined federal and state marginal tax rate in the highest income range is 4575. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Local Option Meals and Rooms Tax.

Vermont State Income Tax Forms for Tax Year 2021 Jan. Read the Vermont income tax tables for Married Filing Jointly filers published inside the Form IN-111 Instructions booklet for more information. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

Vermont School District Codes. PA-1 Special Power of Attorney. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

2016 VT Rate Schedules and Tax Tables. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the. Location Option Sales Tax.

Vermont has four marginal tax brackets ranging from 335 the lowest vermont tax bracket to 875 the highest vermont tax bracket. The site is secure. This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. 6 Vermont Sales Tax Schedule. 7500 25 Of the amount over 50000.

Counties and cities can charge an additional local. Vermont Percentage Method Withholding Tables for wages paid in 2020. 4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax.

8 8 8 8. 18 18 18 18. 2017 VT Tax Tables.

2017 VT Rate Schedules. 2017-2018 Income Tax Withholding Instructions Tables and Charts. 9 Vermont Meals Rooms Tax Schedule.

File Top Marginal State Income Tax Rate Svg Wikipedia

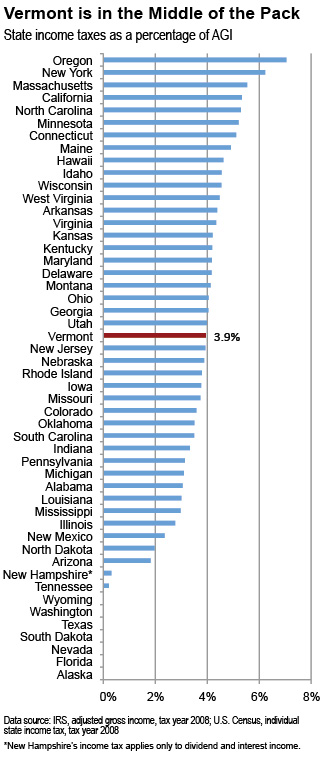

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

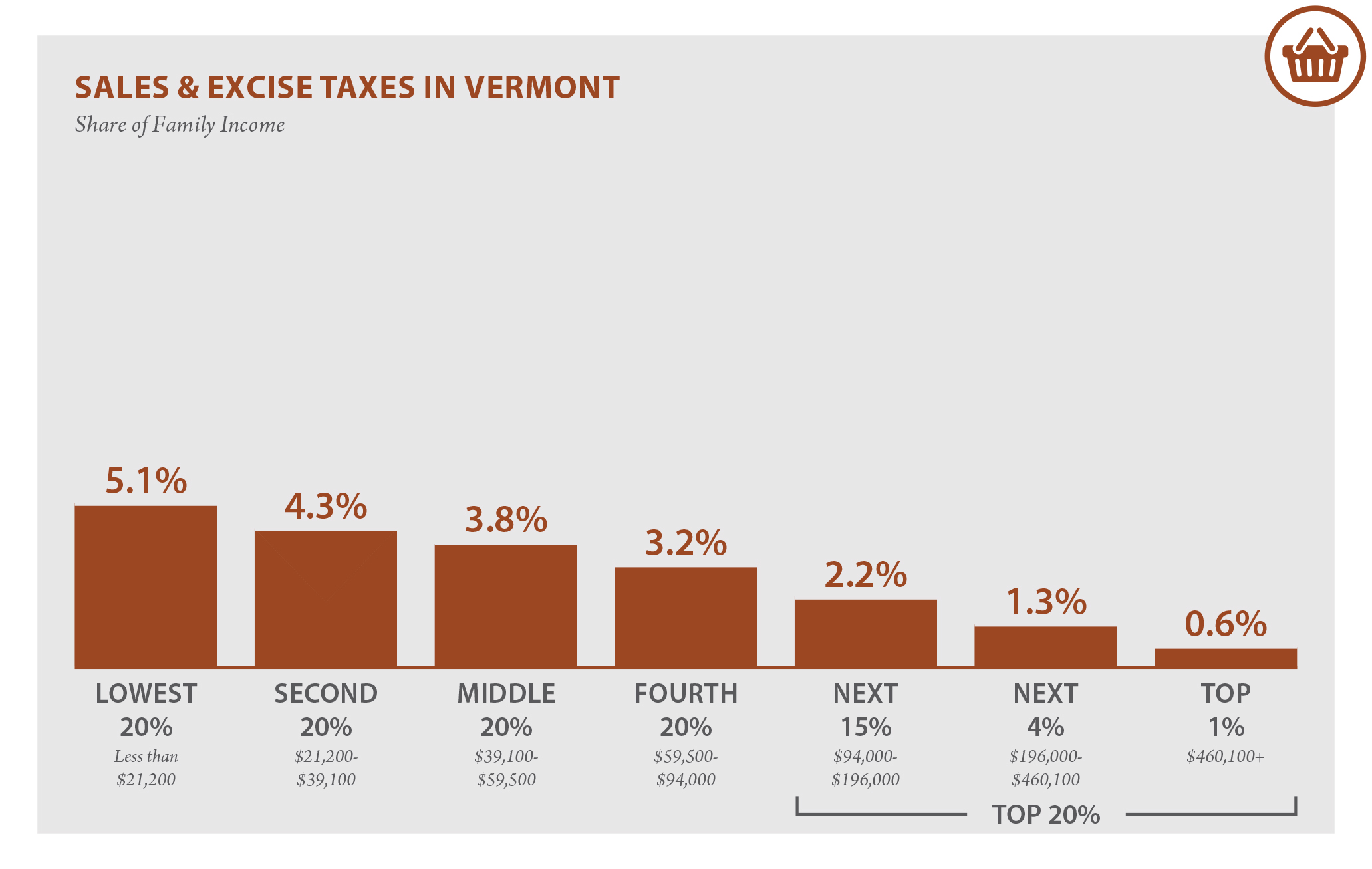

Vermont Who Pays 6th Edition Itep

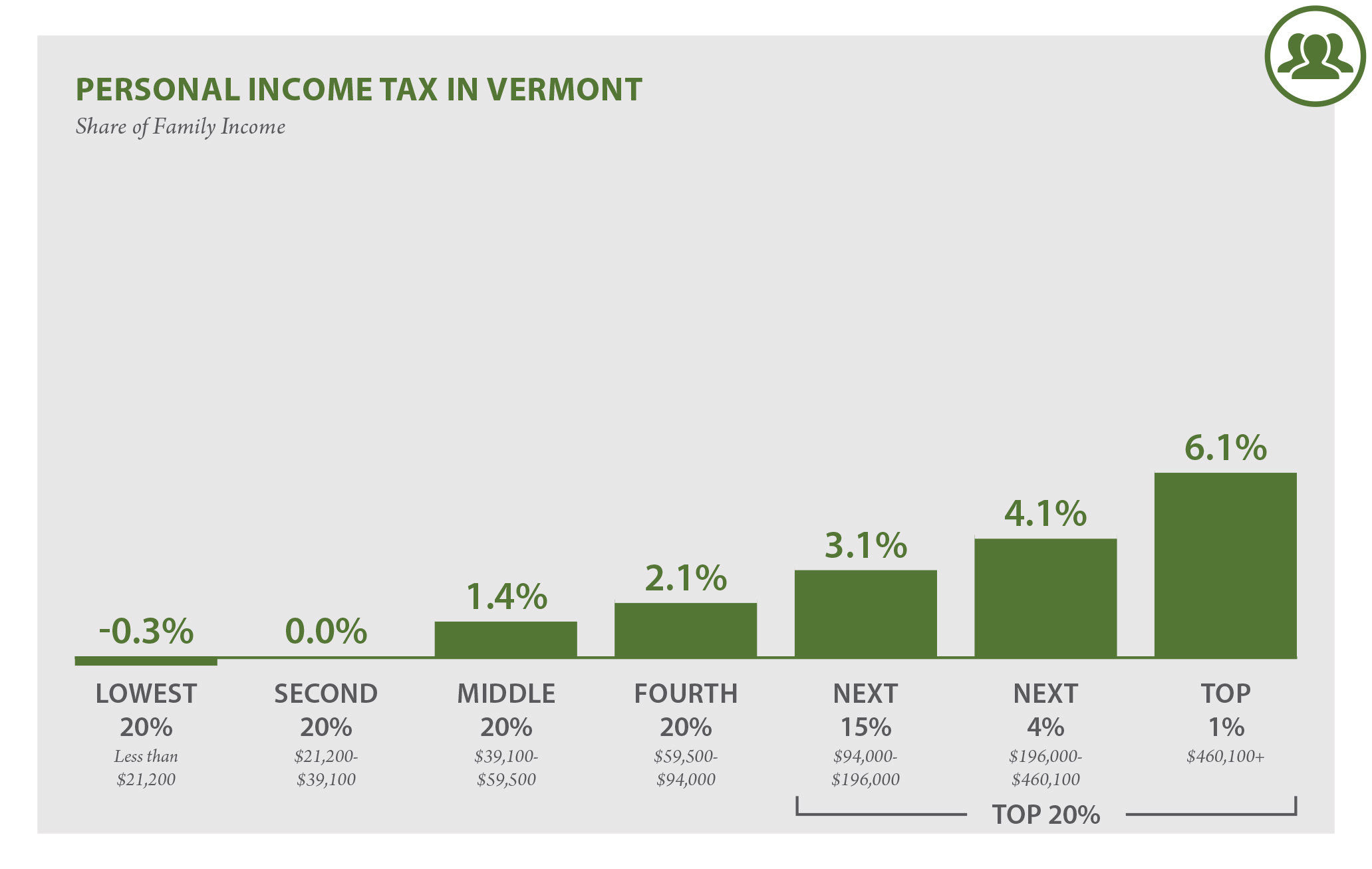

Vermont Who Pays 6th Edition Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

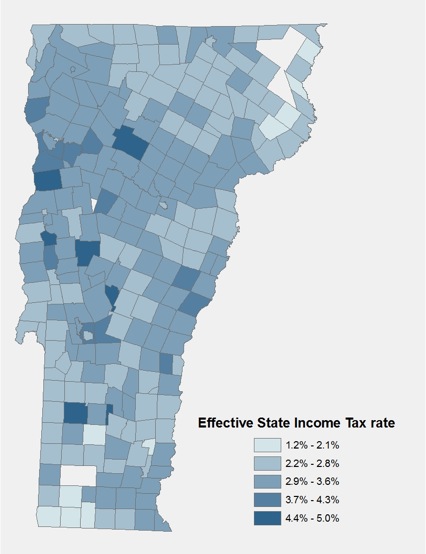

Effective State Income Tax Map Public Assets Institute

Where S My Vermont State Tax Refund Taxact Blog

Vermont Income Tax Vt State Tax Calculator Community Tax

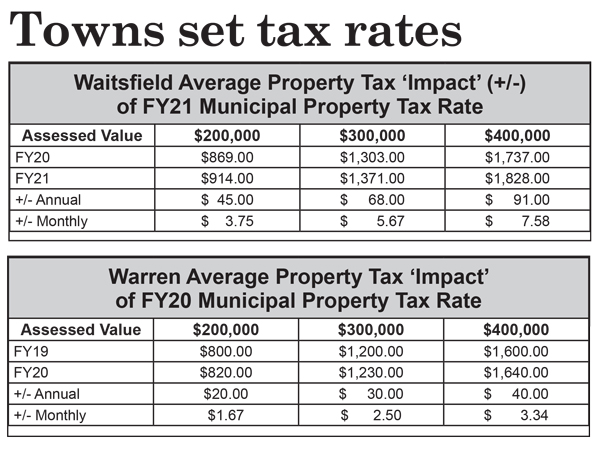

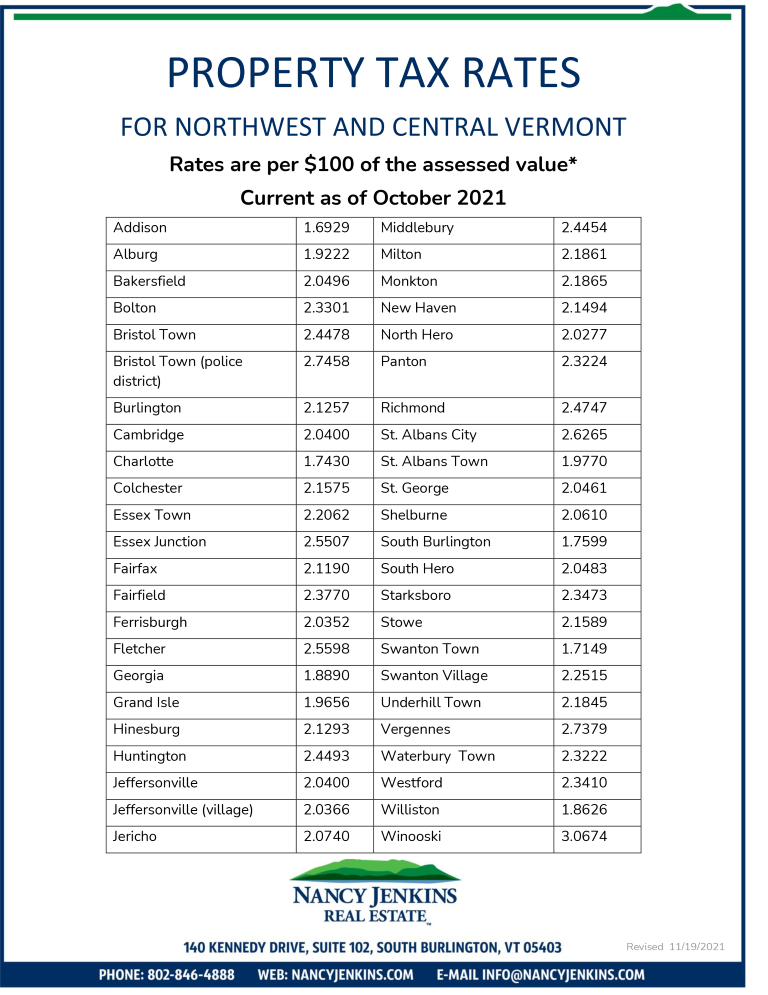

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Sales Tax Small Business Guide Truic

Historical Vermont Tax Policy Information Ballotpedia

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep